About Me

Hui-Ching Chuang is an Associate Professor in the Department of Statistics at National Taipei University. Her research interests include econometrics and investment, with a focus on applying machine learning and natural language processing techniques.[cv]

WORKING PAPERS

- Revisiting the Missing R&D-Patent Relation: Challenges and Solutions for Firm Fixed Effects Models (with Po-Hsuan Hsu, Chung-Ming Kuan, and Jui-Chung Yang)[ssrn][slide][code]

The SFS Cavalcade Asia-Pacific 2024; 2024 UC Davis-FMA Napa Finance Conference; Max Planck I&E Seminar*; 16th NYCU Finance Conference (Keynote)*; 2024 FMA Asia Pacific Conference. (*Presented by Po-Hsuan Hsu)Abstract

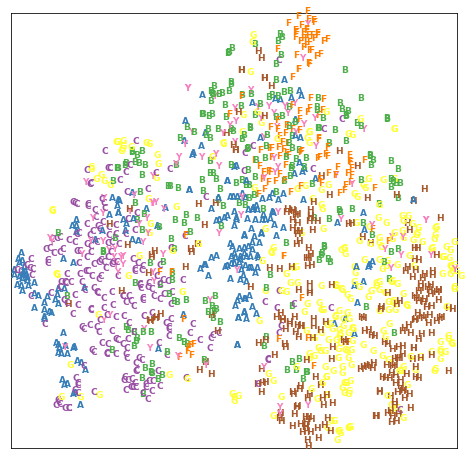

The common practice of including firm fixed effects in empirical researzch may eliminate the explanatory power of important economic factors that are persistent. We use the intuitive R&D–patent relation to illustrate this point. Our review of recent studies suggests a surprising pattern: R&D input positively explains patent output in only half of prior regression estimations. This “missing link” can be attributed to the persistence of R&D and patents, which allows between-firm variation to be absorbed by firm dummies. We consider adjusted Hausman–Taylor estimates and advanced machine-learning methods, both of which restore a clear positive R&D–patent relation. Notably, ML models reveal that only 10-20 % of firm dummies are informative; including the rest biases identification. The paper offers two ready-to-use econometric “second opinions” for researchers dealing with explanatory variables that strongly correlate with between-individual unobservables. - What Share of Patents Is Commercialized? (with Po-Hsuan Hsu, You-Na Lee, and John P. Walsh)

TPRI Brownbag Seminar*; NBER Productivity Seminar*; Max Planck I&E Seminar*; TES 2023; Academia Sinica; NTU; NTPU; YZU. (*Presented by John P. Walsh)Abstract

Leveraging three independent inventor surveys for ground-truth labels, we combine BERT-for-Patents embeddings of each patent’s text with detailed bibliometric variables (citations, assignee type, technology class, etc.) to train machine learning models that assign every U.S. patent a probability of commercial exploitation. This scale-able estimator uncovers previously unobservable commercialization patterns across technologies and filing cohorts, enabling finer analysis of the factors that drive patented inventions to the marketplace. - Classifying Hedge Fund Strategies with Large Language Models: Systematic vs. Discretionary Performance (with Chung-Ming Kuan)[paper][slide]

European Financial Management Association 2025 Annual Meeting, Greece; Quantitative Finance Workshop 3 (Asset Pricing & Risk Management), IMS-NUS, Singapore; 26th Conference on the Theories and Practices of Securities and Financial Markets.Abstract

We fine-tune FinBERT, a finance-specific large language model, to classify hedge funds as systematic or discretionary. Removing manual subjectivity yields cleaner style labels and reveals that systematic funds, on average, generate higher factor-adjusted returns than discretionary funds. After a false-discovery-rate adjustment, 10-20 % of funds still show statistically significant positive alphas in models that include both observable and latent risk factors. - Assessing Risk Spillovers with (Lasso) VAR for Expectile (with O-Chia Chuang, Zaichao Du, and Zhenhong Huang)

28th Conference on the Theories and Practices of Securities and Financial Markets; NTU; TFA 2020; TES 2020; 6th Annual Meeting of Young Econometricians in Asia-Pacific*. (*Presented by O-Chia Chuang)Abstract

We generalize the vector autoregressive (VAR) model from conditional means to conditional expectiles (MCARE) for assessing risk spillovers among multiple entities. For high-dimensional systems, we impose an L1 penalty (L-MCARE). Applied to the return network of global systemically important banks, MCARE and L-MCARE uncover time-varying tail-risk transmission patterns.

PUBLISHED PAPERS

Jui-Chung Yang, Hui-Ching Chuang, and Chung-Ming Kuan (2020).“Double Machine Learning with Gradient Boosting and Its Application to the Big N Audit Quality Effect.” Journal of Econometrics, 216 (1), 268-283.

O-Chia Chuang, Hui-Ching Chuang, Zixuan Wang, and Jin Xu (2024).“Profitability of Technical Trading Rules in the Chinese Stock Market.” Pacific-Basin Finance Journal, 84, 102278.

Yin-Siang Huang, Hui-Ching Chuang, Iftekhar Hasan, and Chih-Yung Lin (2024).“Search Symbols, Trading Performance, and Investor Participation.”International Review of Economics and Finance, 92, 380-393.

Yin-Siang Huang, Hui-Ching Chuang, Iftekhar Hasan, and Chih-Yung Lin (2021).“The Effect of Language on Investing: Evidence from Searches in Chinese versus English.”Pacific-Basin Finance Journal, 67, 101553.

Hui-Ching Chuang and Chung-Ming Kuan (2020).“Identifying and Assessing Superior Mutual Funds: An Application of the New Step-wise Data-Snooping-Bias-Free Test.”Review of Securities & Futures Markets, 32 (1), 1-32.

Hui-Ching Chuang and Chung-Ming Kuan (2010).“Testing the Performance of Taiwan Mutual Funds Based on the Tests without Data-Snooping Bias.”Review of Securities & Futures Markets, 22 (3), 181-206.

Hui-Ching Chuang and Jauer Chen (2023).“Exploring Industry-Distress Effects on Loan Recovery: A Double Machine Learning Approach for Quantiles.”Econometrics, 11 (6).

Hui-Ching Chuang and Jui-Chung Yang (2022).“Dynamic Panel Data Estimators in Leverage Adjustments Model.”Advances in Financial Planning and Forecasting, 10, 67-111.